DC likely voters are overly concerned about the spread of coronavirus and how it will affect both DC’s economy and the health of its residents. Seventy percent (70%) of DC voters are very concerned about the spread of coronavirus, with 65% very concerned about the health of loved ones and 73% very concerned about the local economy.

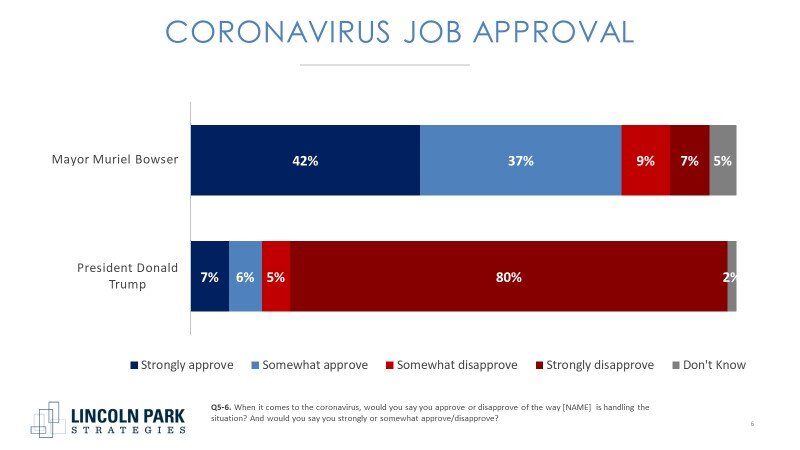

When it comes to approval of the government’s response to the coronavirus pandemic, DC residents are more likely to give high remarks to their local key government figures than federal. Four out of five DC residents approve of the way Mayor Muriel Bowser has handled the coronavirus pandemic. The same cannot be said for President Donald Trump where four out of five of DC voters strongly disapprove and 85% total disapprove of the way he has handled coronavirus.

While the coronavirus approval rating of President Trump and Mayor Bowser stays consistent among all DC residents, it is clear that some demographics sway from the rest.

With DC residents concerned about the spread of coronavirus it is no surprise that a majority want DC schools to be at least partially online this fall. There is no clear consensus on whether schools should be full-time online or partially online, but it is apparent that DC residents do not want it fully in the classroom. While 34% of DC residents would like school to be a combination of online and in-person, a higher percentage (46%) would like school this fall to be entirely virtual.

Interestingly, not all parents have the same opinion on how their child should attend school this fall. White parents are most likely to want their child to attend school in person with around a third (34%) of White parents wanting their child to have a combination of in-person and online learning and 14% want them fully in the classroom. When looking at minority parents, the preference for in-person schooling drops considerably with only 30% of parents of color and 29% of Black parents wanting in-person learning whether full-time or combination.

On the topic of returning to previous life activities during the coronavirus pandemic, a majority of DC residents are ok with opening most businesses as long as there are restrictions. DC residents are most comfortable with offices of less than 50 workers opening up to full capacity (10%) or with some restrictions (73%) while they are less ok with offices with more than 50 people opening to full capacity (5%) or with restrictions (56%). Indoor restaurants have a similar level of comfort, with only 22% of DC residents thinking they should not open up; this differs significantly for indoor bars, which a majority do not think should open even with restrictions.

A majority of DC residents do not share the same opinion across all types of businesses when it comes to the level at which they can open. Around a quarter (23%) of DC residents believe everything should be open with restrictions and 10% believe everything but indoor bars can open with restrictions. It can also be said that only 6% of DC residents think every business should remain closed.