Over the past few years, the United States has been dealing with an increasingly pressing issue; access to affordable housing. Americans have been facing an exponential increase in rental rates (2.61% per year on average) while home ownership seems too far out of reach for many (average home price has increased by 37.5% [17.5% after accounting for inflation] from February 2020 to February 2023). Housing supply has been declining since 2016, reaching a low of 408,922 active housing listings in January of 2022. This also coincided with an increase in prices, the average price of a home was $408,100 in the fourth quarter of 2021 compared to $327,100 in the fourth quarter of 2019.

As anyone looking for a home knows, the housing market has become extremely competitive due to these changes. According to a recent study by the Federal Reserve Bank of New York, only 17.5% of renters say it would be easy to obtain a mortgage right now, this was 20.5% in 2022 and 26% in 2020. Even if you are not actively looking for a home right now, Americans strongly agree that it is a bad time to purchase a home. The housing market being so constrictive has created an increased demand for rental units, leading to high rent increases. Over the past 3 years, rent has increased by 2.61% per year, outpacing wage increases by 169%. Even more depressing, is that if you look back 10 years, average rents have increased 270% more than real wages.

This combination of short housing supply and increasing rents has had detrimental impacts for many Americans. Homelessness has seen an increase of 6% since 2017, increasing to 582,462 homeless Americans in 2022. The levels of homelessness are even more stark when you look at the numbers by race or ethnicity. Native Hawaiians and Pacific Islanders have the highest rates at 121 per every 10,000 people while the rate for white Americans is only 11.

Regardless of where they live, Americans overwhelmingly see housing as an issue with 85% believing affordable housing is a problem and almost half (49%) saying it is a major problem, a 10-point increase from 2018. However, even though Americans recognize this as an issue, their openness to a solution may pose complications when the government looks to implement affordable housing programs and strategies. It has become quite common to see stories about neighborhoods or towns supporting the idea of solving the housing issue but are less willing when the perception is that their own property values might be affected.

In order to solve this problem, Americans must be able to empathize with those facing these issues and remove themselves from an individualistic view of governmental policy. Last month we conducted a national survey to determine how Americans view this issue and their openness to some possible solutions.

Landscape:

According to our research, a majority of Americans report that they live in a standalone single-family home while another quarter live in an apartment building. This is in line with data from the American Community Survey for which shows 67 percent of homes being single-family and 27 percent being multifamily. As is the case with many things these days, race and ethnicity is a big factor in the type of housing people live in.

Just one-fifth of white respondents live in apartments compared to a third of Hispanic Americans and almost two-fifths of African Americans. Women also report living in apartments at higher rates than men, with 8 percent more women living in apartments, on average, compared to men.

Looking at the ownership status of Americans, a little over half of respondents owned their place of residence while renters made up a little less than half. This divide is slightly different than the national rates which are outlined by Property Management in 2022 as 35% of Americans being renters and 65% being owners.

When breaking down the results, renting is much more common among Hispanic, Black, and female respondents. With three-fifths of Hispanic and Black respondents renting compared to less than two-fifths of their white counterparts. In terms of gender, the divide is smaller, with about half of women renting while men rent at thirty-six percent, a 15-point difference.

Furthermore, housing expenses have been a burden to many Americans and an increasingly large portions of individuals’ incomes have been going toward housing in recent years. According to Consumer Reports, the optimal amount to spend on housing is a fourth of an individual’s income. However, the average is 32 percent for married couples, increasing to thirty-six for single Americans.

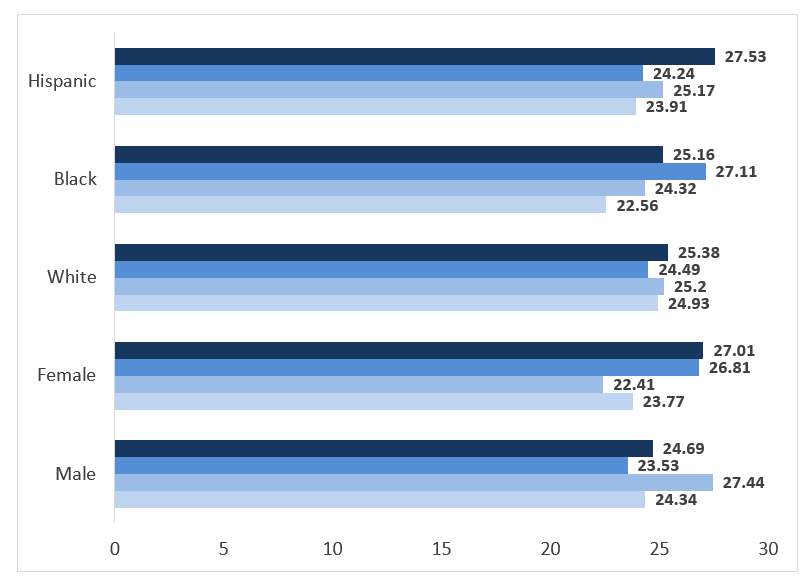

Respondents to this survey, on average, reported spending 38.5 percent of their income on housing expenses. However, over half, 57 percent, said they spend more than the 30 percent threshold outlined by Consumer Reports. One interesting finding is that the largest group of respondents, 16 percent, do not spend any money on their housing.

When breaking this down by demographics, there is a similar divide as seen previously. Hispanic and Black Americans spend, on average, almost 15 percent more of their incomes on housing expenses. Women similarly spend over 10 percent more of their income, on average, on housing than men. All three groups, Hispanic, Black, and women, spend more than the average. With Black Americans spending the highest amount, almost 10 percent more than the average and almost double the suggested 25 percent given by the Consumer Report.

While the issue of homelessness and housing insecurity has seen rising prominence in political discussions, the issue, like many other economic issues, has not reached significant recognition by everyday Americans. A significant number of individuals say they have heard about this issue recently, three-fifths saying they have at least heard a good amount. Only 15 percent say they are not educated or aware about this topic at all.

The breakdowns hold relatively consistent across demographic groups, with Hispanic Americans hearing slightly more than other racial groups and men hearing about it slightly more than women.

In terms of actually experiencing housing insecurity or homelessness, most people have not felt the impacts personally. Over half of respondents have not and do not know anyone who has experienced housing insecurity or homelessness. Not even one-fifth of respondents faced either of these issues, with another quarter saying they know someone directly impacted by these issues.

The breakdowns are much more divided than when the respondents were asked about exposure to the issue. Hispanic and Black Americans experienced housing insecurity or homelessness at much higher rates than white Americans. Seven percent more Hispanic Americans and eight percent more Black Americans experienced these issues first-hand compared to white respondents. Both groups also know someone personally who experienced these issues at rates seven points higher than white Americans. Women also experienced this more frequently than men, however only four-points higher. When it came to knowing others who experienced these issues the rate for women was eleven-points higher than the rate among men.

There are many different reasons people point to as the cause for these rising rates of housing insecurity and homelessness. While some point to the government as being at fault, others will blame the economic market itself and individuals making poor financial decisions, among other causes.

In terms of housing insecurity, all three groups got fairly similar ratings, with the housing market being rated slightly higher. The split between the reasons were all around a third, Americans gave equal blame to the housing market, bad government policies, and individuals decision-making.

However, the breakdowns show a slightly altered opinion, with Hispanic and white Americans having similar breakdowns but African Americans were more inclined to place responsibility on the housing market, rating it 3 points higher, on average, than the other two. A bigger difference can be seen when looking at gender. Men were much more likely to blame the individual, rating them at 34.81, while women only rated them at 29.78, a 5-point difference.

When looking at homelessness, the split is similar even between the four groups provided. All groups held around 25 points on average, the top group being bad government policy but only 1.61 points ahead of the lowest group, mental health issues.

The breakdowns for the responsibility of homelessness highlight similar differences between the demographic groups as seen with housing insecurity. Hispanic Americans are much more likely to blame bad government policies, 2 points higher than white and Black Americans. While Black Americans are still more likely to blame the housing market, 3 points higher than Hispanic and white Americans. Men also hold more blame for individuals’ decision-making, ranking it 5 points higher, on average, than women. Women put more responsibility on the housing market and government policies than individuals and mental health.

Groups which have more exposure and are more economically disadvantaged such as women, Hispanic Americans, and African Americans are less likely to blame individuals for housing insecurity or homelessness. With white Americans and men owning housing at higher rates, spending less on housing expenses, and being less exposed to these issues, they are more likely to blame individuals for succumbing to these economic hardships.

A variety of solutions to homelessness and housing insecurity have been proposed over recent years but none have taken the forefront of political action. While these proposals are still up in the air, some have garnered more support than others.

The proposal supported most strongly is the idea of increasing federal funding in order to fund affordable housing projects. It garnered support from over seven-tenths of Americans, with less than two-tenths opposing.

This support is stronger among racial minorities and women, with ten percent more Hispanic Americans and nine percent more Black Americans strongly supporting it, on average, than white Americans. Eight percent more women strongly support it compared to men. White Americans and men also strongly oppose at rates two times higher than other groups.

Similarly, Americans supported increasing state funding for affordable housing projects at high levels. Showing support for both federal and state governments assistance in resolving the housing crisis.

The breakdowns also looked similar, with twelve percent more Hispanic and Black Americans strongly supporting this proposal than white Americans. Additionally, women supported this proposal at a rate nine-points higher than men.

Also strongly supported is the proposal for more low-income housing projects. Having the same amount of support as the previous two proposals, seventh tenths of Americans would like to see more low-income building projects being pursued by the government.

Hispanic Americans are especially in favor of this proposal as 46 percent strongly support it, outpacing African Americans by eight points and white Americans by fifteen points. Women also stood out as two-fifths strongly support this proposal, compared to 28 percent of men.

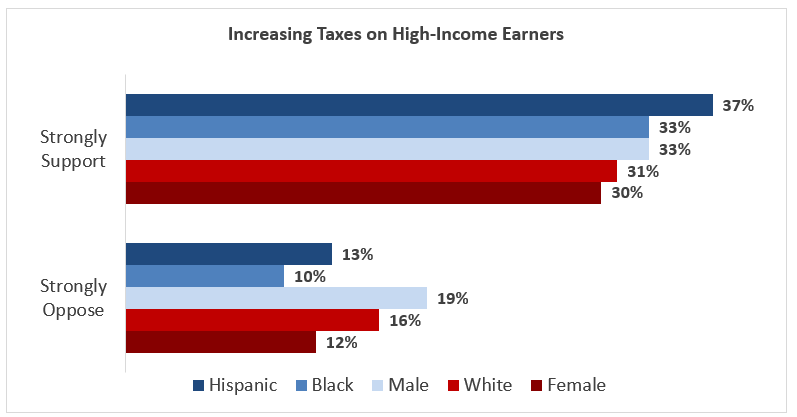

A proposal with not as much support, but still holding three-fifths of respondents, is the proposal to increase taxes on high income earners.

Support is relatively even across demographic groups, with only two percent more African Americans supporting this proposal compared to white Americans. Men support this proposal more strongly than women, supporting by three-points more on average. Hispanic Americans once again stick out as they strongly support this proposal the highest on average, six-points more than white Americans and three-points more than African Americans. Interestingly, men strongly opposed this idea more than women despite strongly supporting it more too. Women held more mild views on this topic while men felt more strongly divided.

Increasing building density is supported by over half of Americans, however, it is not supported as strongly as the aforementioned proposals.

This fell into a similar pattern as seen in the federal and state funding proposals, with Hispanic and Black Americans supporting at a much higher rate than white respondents. Women also held more support than men again, however, only by four points. Strong opposition was again double for white Americans and men compared to other groups.

The only proposal not to receive support from over half of Americans is the proposal to increase everyone’s taxes in order to fund government programs. Receiving only 36 percent of Americans’ support, this is a very unpopular program, especially compared to taxes on only the wealthy which was discussed previously.

This proposal had more even support among demographic groups, being fairly unpopular among all cohorts. However, white Americans and men had much stronger opposition. Men strongly opposed at rates nine percentage points more than women, and white Americans strongly opposed eleven percentage points more on average than Hispanic Americans and double when compared to Black Americans.

The divides between these racial and gender groups hold true throughout most proposals. With men and white Americans being much less open to policies which would seek to solve the housing crisis. As discussed earlier, men and white Americans are more likely to own their homes, live in single-family homes, and less likely to experience homelessness or housing insecurity. Their lower exposure to the issue means their support is much weaker as they do not see these issues holding personal impact in their lives. They would not want the government to commit resources to programs which do not directly benefit them.

While Americans may be open to these solutions to a certain extent, this support often wanes when the policies provided do not positively affect their lives. For example, when discussing a federal minimum wage increase to 15 dollars an hour, support falls around 55 percent according to YouGov. This support drops as household income increases, from 58 percent for households making under 50,000 dollars a year to 47 percent for households making over 100,000 dollars a year. This eleven-point drop is likely due to the minimum wage increase not directly helping wealthier households, they do not see the value in supporting a policy which does not give them personal gain.

However, building density and low-income housing both continued to see high levels of support even with the added personal element. Building density would have a visual and social impact, especially in rural or suburban areas where it is more sparsely populated. Even with these potential negative impacts, these proposals still saw over four-fifths of respondents holding their support for these proposals. There were around 15 percent of respondents for each proposal who lost support when we added that it would occur in their neighborhood, showing there is slight opposition to solutions which impact one’s life personally. This may be due to Americans not viewing these as negative additions to their neighborhoods, not aware of the potential impacts to housing markets, or public resources these policies would have.

The breakdowns for these specific proposals show similar trends as seen with the more general proposals asked previously. With Hispanic and Black Americans holding more support, and Hispanic respondents specifically supporting low-income housing very strongly. As well, female respondents continue to support these at higher rates than male respondents.

White Americans and men are more easily dissuaded from supporting these policy proposals when the solutions are targeted at their neighborhoods. Considering these groups are more likely to live in single-family homes and pay less in housing expenses, they live in wealthier areas on average compared to the other demographic groups. According to the Brookings Institute, people of color made up 64% of the population in the top 50 U.S. cities during 2018 but only 41% of the suburbs around these cities. The Census also states that Black and Hispanic Americans face poverty at rates of 18.8% and 15.7% respectively in 2019, compared to 7.3% of White Americans. Similarly, the Census states how women faced poverty at rates of 12.9% in 2018 while the rate for men was only 10.6%. This means they hold stronger opposition as high density and low-income housing could affect the social and economic status of their neighborhoods negatively. Hispanic, African Americans, and women are more likely to show support as they live in areas where these projects would be beneficial such as urban centers and low-income neighborhoods. Also, they experience housing insecurity at higher rates, meaning they are more open to solutions as they can se the benefits first-hand.

Finally, many see housing as an essential good, similar to food, and believe the government should be taking a role assisting in providing this good to the public. However, some reject this idea and are wary of any kind of government intervention into the housing market.

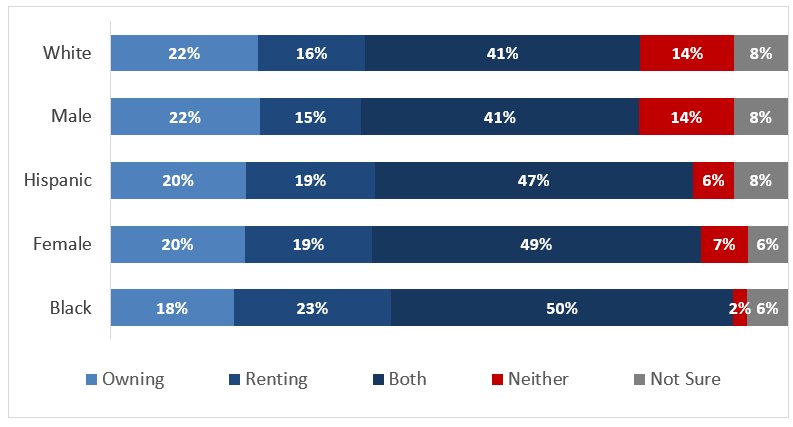

The government takes much different approaches to renting compared to housing support. A significant number of respondents said the government should be taking a role in helping Americans both rent and own, with 44 percent preferring this. Renting had slightly less support than owning, seventeen compared to 21 percent. However, a large majority support some form of assistance, with only 10 percent saying the government should not be involved at all.

White Americans and men are both resistant to government intervention, with 14 percent of each saying neither. This rate is only 6 percent for Hispanic Americans, 2 percent for African Americans, and 7 percent for women. African Americans are most likely to support rent assistance, while white Americans and men both support owning at the highest levels. When referring to the levels of those who rent versus own, this trend correlates as Hispanic, Black Americans, and women all rent at higher levels. Americans are most likely to support policies which will aid them, since white Americans and men do not rent as often as other groups, they support rent assistance at the lowest rates.

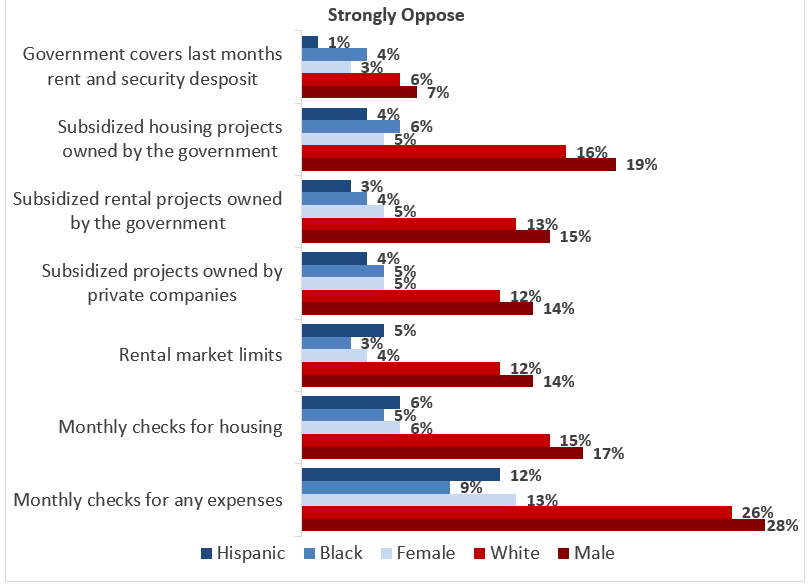

Looking specifically at policies involving government intervention, there is lower support, on average, than the previously discussed policies. The one outlier of this a program where the government would cover the last months rent and security deposit in the form of a loan for low-income renters. Almost fourth-fifths of respondents support this policy, more than all those previously discussed.

The lowest supported were a program where the government would provide checks to individuals for any expenses, they deem necessary and the proposal where the government would subsidize building projects, but they would be owned and operated by private companies. Holding 52 and 57 percent support respectively. The support waning for these shows the lack of trust for both individuals and the housing market. As seen previously, people blame the government, housing market, and individuals equally so Americans do not trust any enough to give them free reign. They do not want Americans to get stimulus from the government for anything they deem necessary as they do not believe it would be utilized for essential goods like housing. They do not support private companies owning the properties as strongly as they hold mistrust in the housing markets attitude toward Americans.

When this data is broken down, Hispanic Americans support all these policies at higher rates than other races. The largest difference was with the proposal to subsidize single-family housing projects which would be sold by the government, where Hispanic Americans strongly support it at 44 percent while for white Americans it is only 22 percent, a fifteen-point difference. Women also support all these policies at higher rates, the largest difference being for the proposal to provide individuals with stimulus checks specifically for housing. 35 percent of women strongly support this proposal while only 23 percent of men do, a twelve-point difference.

As previously observed, men and white Americans are less prone to supporting government intervention policies as they do not recognize a need for it. As they own at higher rates and experience housing insecurity at lower rates, they would not support the government funding these kinds of projects as they are not personally affected by the issues these policies are aiming to solve.

Furthermore, there is much contention when discussing who should qualify for this form of governmental support. Americans hold a range of views, some favoring more restrictions on government intervention while some favor more open welfare programs. Out of the categories provided, the elderly were the most supported with almost two-thirds supporting housing assistance. Five other groups are supported by a majority of respondents with only three not gaining over half support. Part-time workers, students with financial need, and recently employed individuals were the least supported with students and recently unemployed individuals not even receiving two-fifths support.

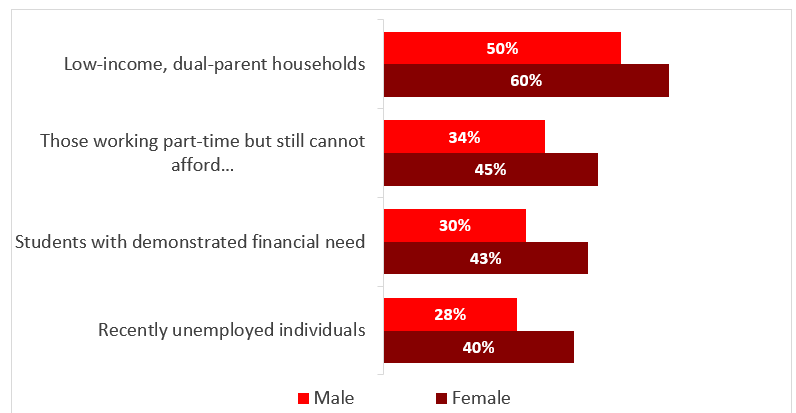

This breakdown continues the trends observed previously, with Hispanic, African Americans, and women being more supportive of government support. The four most drastic differences were with low-income, dual-parent households, part-time workers, students, and recently unemployed individuals. Women support all these groups at rates ten-points more or higher than men. Racial demographics had fewer stark differences compared to gender divides, with the largest difference being with students where Hispanic Americans support providing them with housing assistance 9-points higher than white Americans.

Americans may recognize the rising rates of housing insecurity and homelessness as a pressing issue; however, this acknowledgement does not necessarily correlate with support. While support for a solution may seem strong, it is weaker than it appears when looking at specific groups. Support is strong within communities which are directly impacted by this issue such as racial minorities, women, urban communities, renters, and other economically disadvantaged groups. When it comes to other groups such as men and white Americans, the support wanes, especially when resolutions affect them personally. Policies such as taxes on everyone are much less popular, especially among groups which do not experience housing insecurity and homelessness at high rates. Without the support from groups as large as these, it appears solutions are far from being implemented. Without Americans being exposed personally to these issues and seeing the implications of homelessness and housing insecurity first-hand, support may be difficult to garner.

Next time you are asked your opinion on public policies, consider the people outside your community it may affect. Empathy can prove an essential tool in implementing public policy, showing everyday Americans problems which may not affect them directly are still important.